Navigating the Feast and Famine Cycle in Business

As a successful businesswoman, you’ve conquered numerous challenges so far:

- Started your business and been going long enough for it to be a viable and ongoing concern

- Grown a team, because let’s face it, your clients need and want what you have to offer

- Juggled the balance of work and home life (sometimes, not very successfully but the kids/pets are still alive and you have a healthy waiting list of prospective clients)

And yet, when you look at your bottom line, the profit margins (aka money in your personal bank account) just aren’t showing up as you expect and want them to be.

Yes, you can tweak some expenses, perhaps look at increasing your prices but when you feel like you’ve pulled all the levers and you’re still not feeling rewarded sufficiently for your hard work, then you’re missing a key point.

And this is it – there’s a silent, somewhat uncomfortable, barrier standing between you and your next level of success: your money mindset.

And now is the time to address it, head-on.

Your money mindset is like a silent puppeteer pulling the strings, and if you’re not careful, it will hold you back from creating the financial success you know you’re worthy of.

Your money mindset is this intricate blend of upbringing, culture, family vibes, and life experiences.

It shapes your financial DNA, influencing how you view money, wealth, and success.

Rewind to your childhood… what money messages were whispered in your ear?

For me, it was phrases like “money doesn’t grow on trees” or “you have to work hard for your money” – innocent at first glance, but they built a foundation of money beliefs that I had never stopped to question.

Your money beliefs are like a fingerprint, unique to you based on your life adventures, experiences, role models and upbringing.

The bad news?

Your current results are influenced by your current beliefs.

The good news?

Your money beliefs aren’t carved in stone; it’s just a vibe you have until a breakthrough happens.

Recognising and challenging your beliefs is the secret sauce to propelling your business forward.

So if you are feeling stuck or experiencing a plateau, here’s your call to action:

- Grab a pen and paper.

- Jot down the money belief that’s been pulling the strings right now (i.e. anything that comes after you say the words, I’d be better off financially if/but…)

- Ask yourself the following questions:

- Is it gospel truth?

- What if it’s not?

- What could be a better belief right now?

Challenge your beliefs and notice the impact it has on your bottom line.

If you want some extra help, feel free to reach out.

Helping women break through their money story and build wealth for themselves into the future is something I can talk about until the cows come home!

Meet Nicky & Ness

Double your chance of success with two experienced Business and Leadership Mentors.

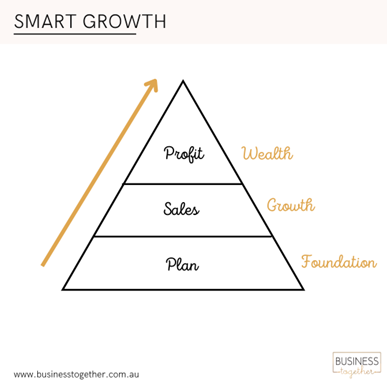

Nicky and Ness are obsessed with helping install smart business growth strategies - without the hard -core hustle and leveraging people leadership for peak performance.

They are two savvy business women who have come together with a shared vision, bucket loads of passion and a burning desire to change hustle culture.

Underpinning everything they do is making sure you’re thriving now and able to thrive into the future as the world continues to change around you.

Supercharge Your Business!

Join us to receive expert podcast episodes and tips on how to achieve the work-life balance you've been craving while still watching your business grow.

Recent Comments